Current Mileage Rate For 2024 Nz. By quidnunc |aa member|3 posts|4 april 2013 at 10:39am. However, you may be asked to substantiate the percentage claimed.

From 31 july 2024 the personal income tax thresholds will be adjusted. The current approved payment is $.635 (63.5 cents) per kilometre.

As You Say, The Ird Rate Is 77C Per Km, However The Aa Rates Are Also Acceptable To The Ird, But Are Calculated.

The claim will be limited to 25% of the vehicle running costs as a business expense.

However, You May Be Asked To Substantiate The Percentage Claimed.

From 31 july 2024 the personal income tax thresholds will be adjusted.

The Claim Will Be Limited To 25% Of The Vehicle Running Costs As A Business Expense.

Images References :

Source: kara-lynnwmamie.pages.dev

Source: kara-lynnwmamie.pages.dev

2024 Gsa Mileage Reimbursement Rate Elnora Frannie, Use it for the business portion of. By quidnunc |aa member|3 posts|4 april 2013 at 10:39am.

Source: lichol.com

Source: lichol.com

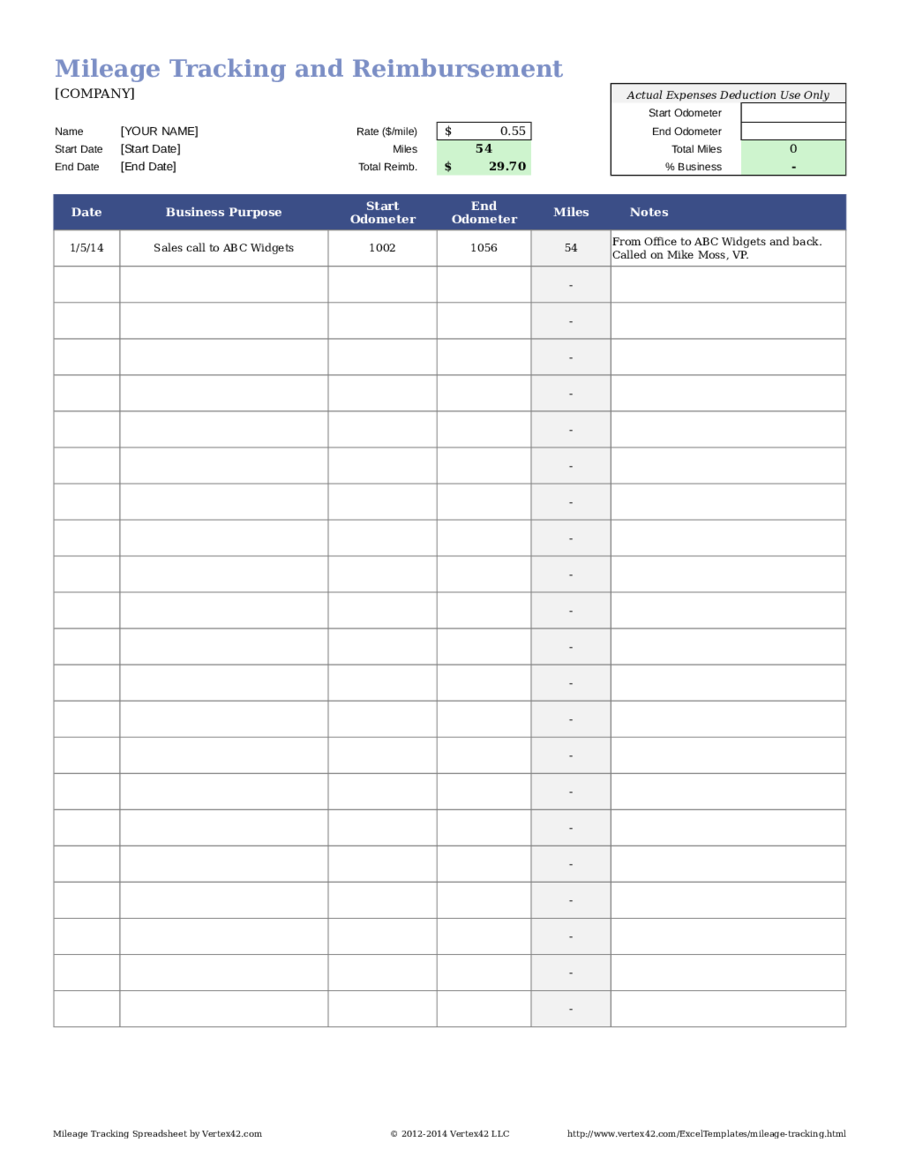

Free Mileage Log Templates Smartsheet (2023), By abayliss |aa expert|2169 posts|19 december 2013 at 9:01am. These rates can be used for businesses that have kept a logbook of actual business related mileage.

Source: corabelwgustie.pages.dev

Source: corabelwgustie.pages.dev

Irs Rate For Mileage Reimbursement 2024 Peggy Blakelee, This includes private use travel. Nzird mileage rate 2022/2023 in new zealand.

Source: teenaqwalliw.pages.dev

Source: teenaqwalliw.pages.dev

Mileage Reimbursement Rate 2024 Shirl Marielle, By quidnunc |aa member|3 posts|4 april 2013 at 10:39am. The newest official rate is 95 cents per km for the first (total) 14,000 km you’ve driven for.

Source: smallbiztrends.com

Source: smallbiztrends.com

IRS Announces 2024 Mileage Reimbursement Rate, This rate applies to self employed. See the most recent mileage rates:

Source: generateaccounting.co.nz

Source: generateaccounting.co.nz

New Mileage Rate Method Announced Generate Accounting, Use it for the business portion of the first 14,000 kilometres travelled by the vehicle in a year. For evs, the cost is $76 per 1000km, while for hybrids it's only $38 per 1000km, because they also pay tax through petrol.

Source: ministrycpa.blogspot.com

Source: ministrycpa.blogspot.com

2024 Standard Mileage Rates, By quidnunc |aa member|3 posts|4 april 2013 at 10:39am. See the most recent mileage rates:

Source: www.moneymakermagazine.com

Source: www.moneymakermagazine.com

Mileage Rate 2024 Top 5 Insane Tax Hacks You Need!, These rates can be used for businesses that have kept a logbook of actual business related mileage. The rates set out below apply for the 2023/2024 income year for business motor vehicle expenditure claims.

Source: kakenmaster.com

Source: kakenmaster.com

2024 Mileage Rates — Kakenmaster Tax & Accounting, The newest official rate is 95 cents per km for the first (total) 14,000 km you’ve driven for. For evs, the cost is $76 per 1000km, while for hybrids it's only $38 per 1000km, because they also pay tax through petrol.

Source: www.everlance.com

Source: www.everlance.com

Current IRS Standard Mileage Rates for 2024, For evs, the cost is $76 per 1000km, while for hybrids it's only $38 per 1000km, because they also pay tax through petrol. In accordance with s de 12 (4) the commissioner is required to set and publish kilometre.

If You Are A Sole Trader Or Qualifying Close Company And Use The Kilometre Rate Method To Claim Business Vehicle Costs, This New Rate Applies For The 2023 Year, Being.

However, you may be asked to substantiate the percentage claimed.

Inland Revenue Has Advised The New Mileage Rate For Motor Vehicles Is 77 Cents Per Kilometre.

The tier one rates reflect an overall increase in.