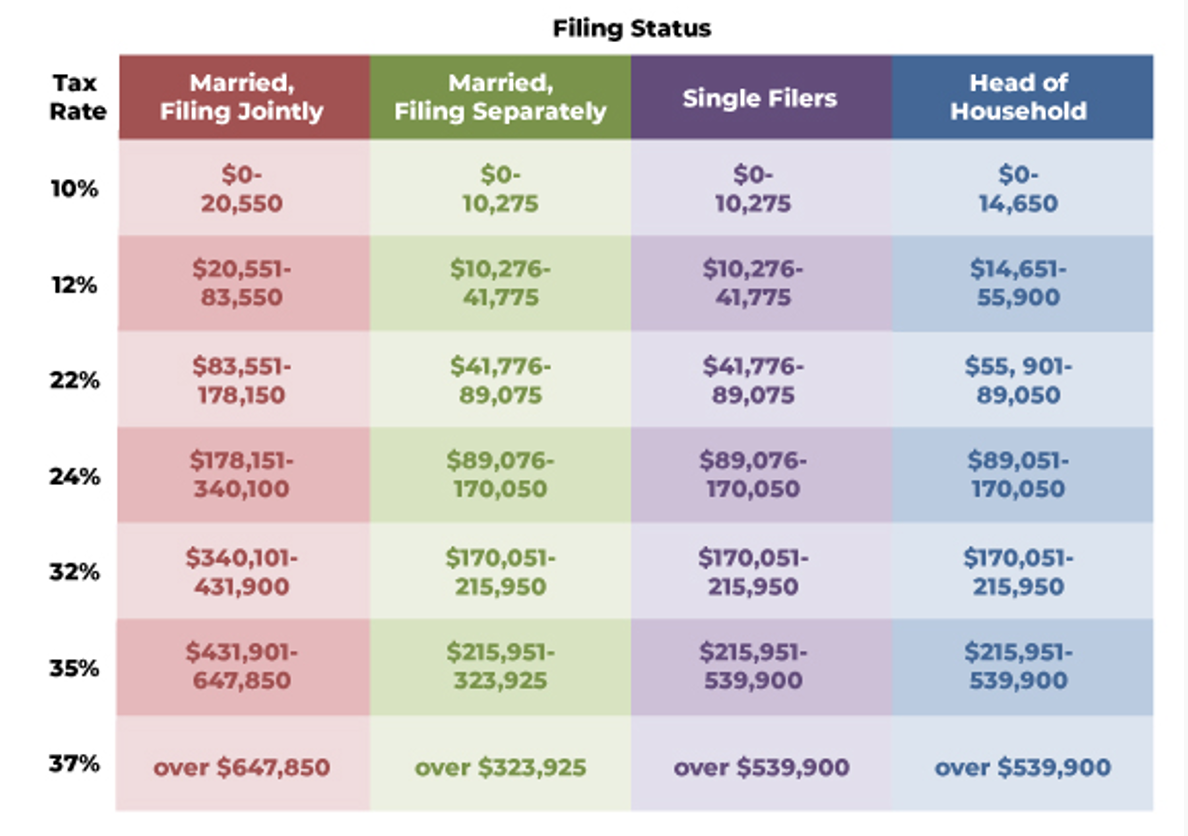

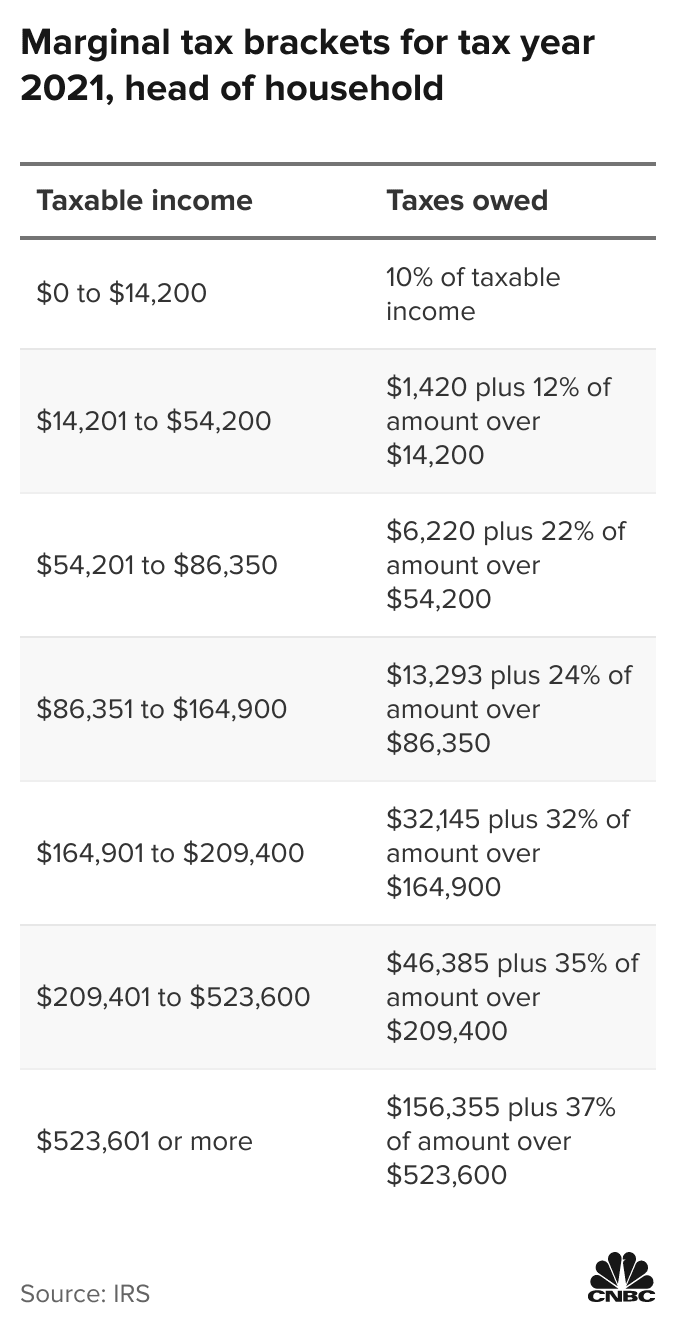

2024 Tax Rates And Brackets Head Of Household. Married couples filing separately and head of household filers; 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Use this effective tax bracket calculator to estimate your 2024 taxes and rates or use our free 2024 tax refund calculator to estimate your 2024 taxes and get ready to efileit. For tax year 2024, the top tax rate.

2024 Tax Rates And Brackets Head Of Household Images References :

Source: bonnieyletitia.pages.dev

Source: bonnieyletitia.pages.dev

2024 Tax Brackets Head Of Household Married Jointly Marga Salaidh, For tax year 2024, the top tax rate.

Source: vikiqsheela.pages.dev

Source: vikiqsheela.pages.dev

Tax Brackets 2024 Head Of Household Ange Maggie, 2023 vs 2024 tax brackets for head of household

Source: jennicawhollie.pages.dev

Source: jennicawhollie.pages.dev

2024 Tax Brackets Head Of Household Elli Shanie, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023;

Source: taxedright.com

Source: taxedright.com

2024 Tax Brackets Taxed Right, 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Source: jackquelinewkoo.pages.dev

Source: jackquelinewkoo.pages.dev

2024 Tax Brackets And Rates carlyn madeleine, There are seven (7) tax rates in 2024.

Source: karlaqmirelle.pages.dev

Source: karlaqmirelle.pages.dev

2024 Tax Brackets Single Head Of Household Inez Madeline, Single, married filing jointly or qualifying widow (er), married filing separately and head of household.

Source: carleeycostanza.pages.dev

Source: carleeycostanza.pages.dev

2024 Tax Rates By Tax Act Genny Jaquelin, 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Source: saraqsashenka.pages.dev

Source: saraqsashenka.pages.dev

Federal Tax Brackets 2024 Head Of Household Danna Lisette, Yep, this year the income limits for all tax brackets will be adjusted for inflation, so let’s take a closer look at what tax rates and tax brackets are and how they change how much you pay in federal income tax.

Source: louisettewtove.pages.dev

Source: louisettewtove.pages.dev

Tax Brackets 2024 Head Of Household Corri Doralin, And for heads of households, the standard deduction will be $21,900 for tax year 2024, an increase of $1,100 from the amount for tax year 2023.

Source: vilhelminawgilly.pages.dev

Source: vilhelminawgilly.pages.dev

Federal Tax Brackets 2024 Head Of Household Jana Rivkah, To figure out your tax bracket, first look at the rates for the filing status you plan to use:

2024